How To Invest Money Through Wells Fargo

What Is the Wells Fargo Money Order Fee?

- Cost

- Fee Comparison

- How To Get One

- How To Avoid Scams

- Bottom Line

Northfoto / Shutterstock.com

A money order allows individuals to exchange payment securely. Because you pay the face value of the money order upfront, it's a guaranteed form of payment — unlike a check. Money orders are available at various banks and retailers, and you'll usually pay a fee. Wells Fargo's money order fee is $0 to $5, depending on the type of checking account you have.

Cost of a Wells Fargo Money Order

Money orders are available from Wells Fargo in amounts up to $1,000. Here are the fees based on the type of checking account.

| Wells Fargo Checking Account Type | Money Order Fee |

|---|---|

| Everyday Checking | $5 |

| Clear Access Banking | $5 |

| Preferred Checking | $0 |

| Portfolio by Wells Fargo | $0 |

How Wells Fargo Money Order Fees Compare to Other Banks' Fees

Wells Fargo's money order fees are comparable to those of other banks. The fee you'll pay depends on the type of account you have. Out of the following banks listed, only Chase offers free money orders to all of its personal checking customers, no matter what type of account they hold.

| Bank | Money Order Fees |

|---|---|

| Chase | $0 for personal checking account holders, $5 for savings account holders |

| U.S. Bank | $0 to $5 |

| TD Bank | $0 to $5 |

| Citibank | $0 to $5 |

How To Get a Wells Fargo Money Order

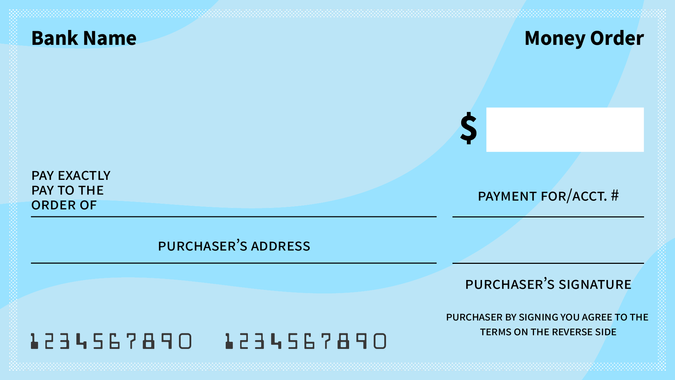

To purchase a Wells Fargo money order, you'll need to visit a branch. Money orders are not available to purchase online. Here are some tips on how to get and fill out a money order.

Steps To Get a Wells Fargo Money Order

- Visit a teller's station at your local Wells Fargo branch, and request a money order.

- Write the individual's or business's name on the "Pay to the order of" line.

- Write your name and signature in the appropriate places.

- Write your address, if applicable.

- Include any account numbers to route the payment to the correct place, if applicable.

- Get a receipt and keep it until you know the money order has been received and cashed.

How To Avoid Money Order Scams and Fraud

The most common money order scams involve a con artist using a fake money order that leaves the recipient liable for the amount. The fake money order may be used to gain access to a valuable item without actually paying for it. Or, a scammer could use it to buy something from you and then quickly demand a cash refund — leaving you with the worthless money order.

Unfortunately, it can take longer than a week after you deposit a money order for your financial institution to realize the fraud, which will leave you to cover the money that's been spent or refunded.

Ways To Avoid Money Order Scams and Fraud

- Make sure the money order is real.Look on the money order for the issuer's name and number, and call to verify the money order's serial number.

- Inspect the amount closely. A money order made out for $100 could be altered to read $1,000. Look for signs that the amount of the money order has been altered.

- Examine the design of the money order.Some issuers use authenticity features, such as inlays or watermarks. If you're unsure that the money order is real, take it to the issuer and ask for an opinion.

- Refuse to deposit a money order and give back cash.If the money order is fake, you'll likely be liable.

- Refuse to take a money order from someone who seems desperate.The desperation could be a sign of someone who is trying to pull off a scam and then disappear.

- Wait until the entire amount of the money order clears — or until after you verify it's real — before spending the funds, releasing the item you sold or issuing a refund. All of these conditions may be an inconvenience to you and the person who gave you the payment, but it could save you from being liable for a fake money order.

Are Wells Fargo Money Orders Worth It?

If you have one of the checking accounts that waive the money order fee, getting a money order from Wells Fargo is worth it because it won't cost you anything. But if your account doesn't include freebies, you might want to find other places to get a money order. Otherwise, the only reason to get a money order from Wells Fargo would be as a matter of convenience if you're already planning to visit a branch.

Fees subject to change. Information is accurate as of April 19, 2021.

This content is not provided by Wells Fargo. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by Wells Fargo.

Cynthia Measom is a personal finance writer and editor with over 12 years of collective experience. Her articles have been featured in MSN, Aol, Yahoo Finance, INSIDER, Houston Chronicle, The Seattle Times and The Network Journal. She attended the University of Texas at Austin and earned a Bachelor of Arts degree in English.

Check Out Our Free Newsletters!

Every day, get fresh ideas on how to save and make money and achieve your financial goals.

How To Invest Money Through Wells Fargo

Source: https://www.gobankingrates.com/banking/banks/what-wells-fargo-money-order-fee/

Posted by: romriellsignatich.blogspot.com

0 Response to "How To Invest Money Through Wells Fargo"

Post a Comment